EMA and Stochastic

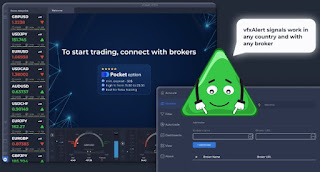

The approach to binary options trading outlined here demonstrates consistent profitability across various instruments in the Forex market. It incorporates signals from the adaptive strategy vfxAlert and technical indicators that have withstood the test of time among multiple generations of traders. This strategy, characterized by its simplicity, is easily accessible even for beginners, as the indicators employed are standard in all widely-used trading platforms.

Key Components of the Strategy:

1. Exponential Moving Average (EMA):

- Period = 14 (1 EMA)

- Period = 9 (2 EMA)

2. Stochastic Oscillator:

- Period %K = 13

- Period %D = 3

- Smoothing = 3

Signal Conditions:

- **CALL:** Stochastic is above level 20, its graph trends upward, and the current candle closes above the moving averages.

- **PUT:** Opposite conditions apply - Stochastic below level 80, and the candle closes below the middle.

How to Open a Position:

The optimal entry point is the first candle closing above or below the moving averages with proper Stochastic movement. It's crucial to observe Stochastic exiting overbought (80) or oversold (20) zones. On the M1 chart period, a position can be opened on the second candle if the first is missed, but it's advisable to await the next signal.

Expiration Time:

Not less than 3-5 candles within the working timeframe.

Additional Advice:

- This strategy consistently yields profits on most currency pairs. Opt for currencies in line with the current trading session.

- Beginners should only open options after the moving average graph crosses. Avoid positions if vfxAlert indicates a strong opposing signal.

- Pay special attention to significant fundamental news and statistics. It's generally advised to refrain from trading during such periods due to market instability. However, in one-minute timeframes during news trading, opening an option in the direction of the news with confirmation from the adaptive strategy vfxAlert is feasible.

Insight into Stochastic:

Approximately three decades ago, the prevailing belief among market analysts was that predicting exchange prices was nearly impossible due to numerous influencing factors. However, the systematization of exchange trade experience and the advancement of computer technology showcased the potential for predicting market price behavior. This led mathematicians to develop various methods, now known as "indicators."

While thousands of indicators exist, the stochastic oscillator stands out. Developed by George Lane in the early 1950s, it gained popularity alongside other well-known indicators like the Relative Strength Index (RSI). The stochastic is widely available on various platforms, yet many traders, especially beginners, often misuse it. Understanding its correct application is key to maximizing its effectiveness in trading systems.

Комментарии

Отправить комментарий