Unlocking the Potential of Technical Indicators and Trading Software for Optimal Profits

In the ever-evolving landscape of financial markets, mastering the art of trading demands a deep understanding of technical indicators. For traders navigating the fast-paced 1-minute chart, leveraging the best trading indicators can be the defining factor between success and uncertainty.

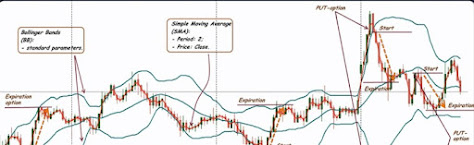

Technical indicators serve as beacons, illuminating potential market movements based on historical price data and various mathematical calculations. Among the plethora of options available, a few standout indicators have proven their worth on the 1-minute chart.

The Moving Average Convergence Divergence (MACD) stands tall among the best trading indicators. Its ability to spot changes in momentum and identify potential trend reversals makes it indispensable. Pairing this with the Relative Strength Index (RSI), a momentum oscillator, can provide a comprehensive view of overbought or oversold conditions, guiding traders to lucrative entry and exit points.

However, mastering these indicators requires more than theoretical knowledge. Implementing them effectively demands the right tools. Enter trading software – a game-changer in today’s dynamic markets.

But it’s not just about having the tools; it’s about using them smartly. Integrating these indicators into a coherent strategy tailored for the 1-minute chart requires patience, practice, and adaptability. Backtesting strategies using historical data can refine the approach, highlighting the strengths and weaknesses before risking capital in live markets.

Furthermore, staying updated with market trends and continuously honing one’s understanding of these indicators is imperative. The markets are dynamic, and so are the indicators; what works today may evolve tomorrow.

Successful trading is not solely about identifying entry and exit points; risk management plays a pivotal role. Even with the best trading indicators and cutting-edge software, risk control remains paramount. Implementing stop-loss orders and position sizing strategies mitigates potential losses and safeguards profits.

Ultimately, the synergy between technical indicators and trading software unveils a realm of opportunities for traders on the 1-minute chart. However, success lies not just in adopting these tools but in mastering their application. The path to consistent profits demands dedication, discipline, and a continuous quest for knowledge.

In conclusion, discovering the top technical analysis indicators for 1-minute chart trading and enhancing your trading strategy with powerful software can be a game-changer. Integrating these tools effectively can maximize profits and pave the way to trading mastery in today’s dynamic financial markets.

Комментарии

Отправить комментарий