We trade price breakouts. Detailed Guide

Combining breakout strategies with the VFXAlert platform can significantly enhance your trading experience, irrespective of your expertise level in trading.

Setting up VFXAlert:

Begin by downloading the VFXAlert app to receive real-time signals, an essential component for any breakout trading approach. This application generates both CALL and PUT signals based on extensive historical and statistical data, serving as supplementary confirmation for your trading strategy.

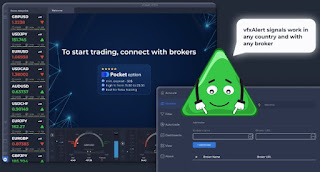

1. To initiate trading, connect with your broker's platform via the VFXAlert application using a dedicated form. While our trading occurs on Pocket Option, this strategy has proven effective on various other broker platforms. It's important to note that VFXAlert signals are universally applicable across countries and brokers. Refer to the instructions in this article for seamless integration of a broker into the platform.

2. Select assets without additional hidden fees, adjust quantities, and configure charts within your broker's platform. Optimal analysis timeframes generally range from M1 to M5. Longer analysis periods usually result in increased signal accuracy over time.

Adding Technical Indicators:

Incorporate technical indicators like default Bollinger Bands, indicating potential price reversal points. The upper band signifies a probable resistance level, while the lower band acts as a support level. Additionally, utilize the 5-period and 20-period SMAs to identify price trends.

3. Trading breakouts demands attentiveness and quick response to price changes. Execute trades swiftly with a single click on your broker's platform using the quick button on the VFXAlert signals panel. Set up the desired signal preset for ease of execution.

Identifying Entry Points:

Breakout Up (Call Option): Triggered when the price crosses above the upper BB, accompanied by the short-term MA crossing down through the long-term MA.

Breakout Down (Put Option): Noted when the asset's price crosses below the lower BB, along with the short-term MA crossing down through the long-term MA.

Usage Recommendations:

Ensure that your position size aligns with a predetermined percentage of your trading capital, typically not exceeding 2%.

Exit a breakout trade when the price crosses the short-term moving average in the opposite direction, in adherence to your breakout trading strategy.

Stay updated on news and events that might impact the market, especially when trading on short timeframes.

Practice and discipline are crucial for breakout strategies. Prior to using it in a live account, consider testing it on a demo account.

The breakout strategy, coupled with VFXAlert integration, empowers even novices to confidently identify and engage in profitable trading options.

If you want to learn more about this strategy, you can read it here:

Article in English

Article in Spanish

Article in Portuguese

Article in French

Article in Hindi

Article in Turkish

Комментарии

Отправить комментарий